Transforming to

deliver optimal returns

Union bank demonstrated a clear and sustainable path to growth over the course of fy2022, delivering a return on average assets (ROAA) of 0.47 in fy2022, a marked improvement over an ROAA of 0.27 in fy2021. We will continue to develop the diversified business model that we have established, investing in advanced technology and digital capabilities in our consumer businesses, delivering sustainable growth across our domestic and global operations, and play a meaningful part in aiding the transition to a low-carbon economy.

Building on resilience,

consistency and growth.

For FY2023, we aim to attain

~10% deposit growth and one

of lowest Credit Cost ratios in

the industry at <1.5%.

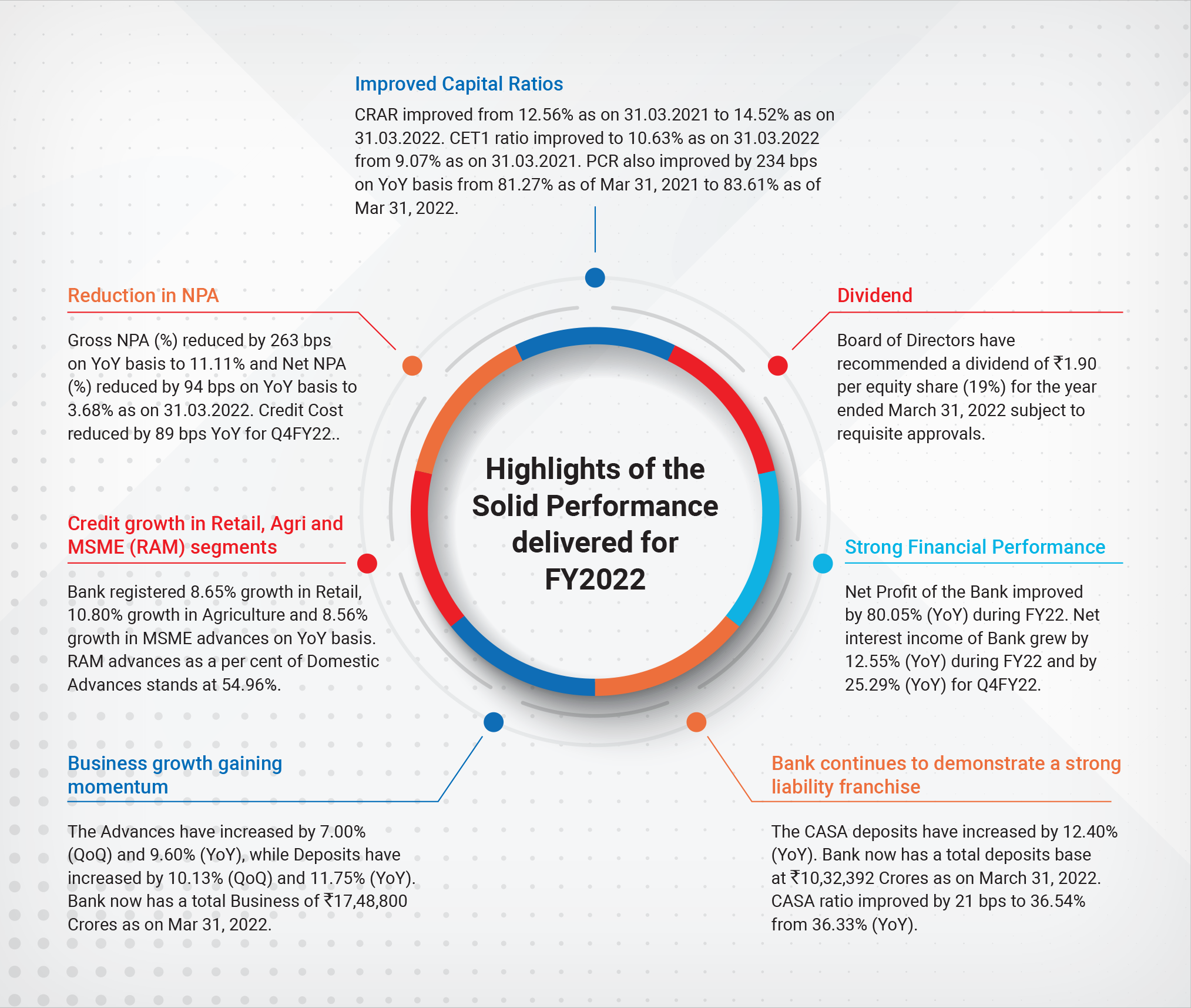

Financial Highlights for FY2022