Delivering the next-generation,

digitised consumer financial services

The covid-19 pandemic inevitably brought challenges for our consumer-facing businesses. It also accelerated several existing customer and client behaviour trends that we have seen continue during 2021 and well into 2022, in terms of our clients not requiring a physical branch visit or in-person engagement. A continued significant shift toward digital adoption and demand for digital financial services to meet day-to-day needs has accelerated our digital agenda and focused on creating new business models built around digital customer and client engagement.

One of our core priorities is to deliver next-generation, digitised consumer financial services to ensure we remain competitive and continue to meet the needs of our customers and clients while maintaining our societal obligations to provide access to banking. Union bank of india is offering a digital experience to its customers by leveraging and implementing the latest innovations in technology like cloud computing and digital lending, amongst other capabilities. You bank is transforming the current it architecture to ensure high-performance access to business systems and cloud based applications, complying with regulatory norms without compromising security. At the same time, your bank is fostering enterprise solution architecture practices for new applications to support innovations in diverse, dynamic and complex environments.

During fy2021-22, bank has decided to invest more than ₹1,500 crore on digitization initiatives for bringing next generation digitized consumer financial services.

Progress on Digital Channels

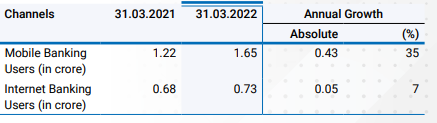

Growth in Digital Channels (figures in crore)

We continue to oversee our evolving consumer businesses as this priority is driven forwards, ensuring we keep the focus on meeting consumer demand and responding to changing behaviour while at the same time ensuring the bank becomes more efficient in its operations. We talk about this at length in our management discussion and analysis report.

To ensure we deliver sustainable long-term returns for our investors, the board and management have contemplated the importance of operating a service model that is responsive to evolving customer and client expectations and enables union bank of india to remain competitive and highly relevant to todays consumer desires and behaviour.

Union bank of india has also continued to play an essential role in using technology and our monitoring capabilities to help manage and maintain the quality of our assets. Read more about our investments in security systems and vigilance that protect against fraud and scams in our management discussion and analysis report.

Critical to the successful delivery of this priority will be creating the future workforce. We are committed to attracting, developing, and retaining a diverse and inclusive workforce that embeds essential skills, such as digital and technology, and the capabilities needed to succeed. Our management discussion and analysis report on page 309 provide more detail on our talent development work.

Key Strategy:

Delivering the next-generation,

digitised consumer financial services

One of our core priorities is to deliver next generation digitised consumer financial services to ensure we remain competitive and continue to meet the needs of our customers and clients while maintaining our societal obligations to provide access to banking.

We want to be the vanguard of the industry in terms of embedding digitization across our full range of banking processes and services.

Robust and Resilient Infrastructure

During FY2022 your banks private cloud was expanded to currently host 600+ virtual machines running 130+ applications on cloud the bank also established a robust CBS infrastructure to support daily financial transaction volume of 5+crore currently monthly average CBS transactions are 155+ crore your bank also implemented the SD-WAN solution which will provide a centralised approach to network management more network automation simplified operations reduced change control standardised email messaging system with advanced security features

Customer EASE (Enhanced Access & Service Excellence)

Union bank of India has established a dedicated application performance monitoring team to ensure proactive issue resolution and 24/7 service availability the average uptime of it systems is 99.90% which is at par with the best in the industry.

Empanelment of FinTechs

Fintech policy of the bank provides for empanelment of FinTechs to create a pool of companies having developed unique financial services a readily available collection of FinTechs helps the bank adopt the required solution within the shortest possible time based on the market study and expected requirements of the Bank, 24 FinTechs have been empaneled under various service segments.

During FY2021-22, Bank has decided to invest more than ₹ 1,500 crore on digitization initiatives for bringing next generation digitized consumer financial services.

The Digital Conclave at Mumbai

Union Bank of India recently conducted its maiden Digital Conclave to mark its foray into creating a Digital Bank within Bank. During the Conclave, Shri Rajkiran Rai G, MD & CEO, unveiled Union SAMBHAV World of Opportunities, a Future Digital ready transformation project, and its upcoming Super App named Union nxt Do it Yourself. The main thrust of these digital initiatives is to empower Customers with Smarter Ways of doing Banking a cross all segments, predominantly Do it Yourself (DIY). With customer experience as the primary objective(Design Thinking), Five Customer Centric Digital Lending (end to end STP) journeys viz, Pre-approved Personal Loan (PAPL), Union Cash(Pensioner loan), Shishu Mudra Loan, MSME Loan-Auto-renewal, Agri loan (KCC)- Auto-renewal were unveiled during the Digital Conclave including the new data-driven vibrant products & services on Banks Mobile Banking. The event also witnessed the rolling out of digital applications, viz. SoftPos & CRM Application. Speaking on the occasion, Shri Rajkiran Rai G, MD&CEO, Union Bank of India, remarked that With the embark of project Sambhav World of Opportunities and Super App, I am confident that Union Bank of India will deliver real-world value to its Customers through an accelerated Digital Transformation, both as a business ideology and enterprise imperative.

Recognition and Awards

EASE 4.0: Your Bank secured “3rd position under the ThemeTech Enabled Ease of Banking” for the December 21 Quarter in EASE 4.0.

Union Bank of India was awarded the Best Cloud Adoption in Large Category bank as Bank has recognised the significant potential of the cloud technology in providing modern infrastructure for Banking at a very early stage and implemented on-premises private Cloud in 2017.

Union Bank of India was awarded Runner Up in Infosys Finacle Innovation Award 2021 under the Process Innovation Category for the Bank’s innovation strategy, which is centred around customers to provide a superior experience at all stages of the customer journey in every sphere of Banking through exceptional touchpoint experience and agile services.

Union Bank of India was awarded IDC industry Innovation Awards 2021 under Innovation in Operations as Bank is architecting the future by driving business growth and creating competitive advantages through emerging technologies and continuous innovations.

As per the rank list released by IBA, Union Bank of India is ranked 3rd among 12 PSBs in the EASE 4.0 Reforms Index forQ1 FY22. The Bank has been actively adopting the reforms initiatives recommended under the EASE Agenda, enabling it to retain the overall position of the second runner up for the last three consecutive quarters since December 2020. The Bank has also recorded stellar performance under four out of six themes on the agenda. The Bank was adjudged the winner in the themes ‘Collaborating for synergistic outcomes’ & ‘Governance & outcome-centric HR’ and bagged the runner-up positions in ‘New age 24×7 Banking’ & ‘Tech-enabled ease of banking’ themes